The best way we recommend to find low-cost prices for car insurance rates is to start doing an annual price comparison from different companies who can sell car insurance in Nashville. Price quotes can be compared by following these steps.

The best way we recommend to find low-cost prices for car insurance rates is to start doing an annual price comparison from different companies who can sell car insurance in Nashville. Price quotes can be compared by following these steps.

- Learn about how companies price auto insurance and the modifications you can make to lower rates. Many rating criteria that drive up the price like traffic tickets, fender benders, and poor credit rating can be remedied by making small lifestyle or driving habit changes.

- Request rate estimates from direct, independent, and exclusive agents. Exclusive agents and direct companies can provide rates from a single company like GEICO and State Farm, while independent agents can quote rates for a wide range of insurance providers.

- Compare the new quotes to the price on your current policy and see if there is a cheaper rate. If you find a lower rate quote, make sure there is no coverage gap between policies.

- Provide notification to your current agent or company of your intention to cancel your current car insurance policy. Submit the signed application along with the required initial payment to the new company. When you receive it, store the proof of insurance paperwork in your vehicle’s glove compartment or console.

The key thing to remember is to compare the same liability limits and deductibles on every quote request and and to get quotes from all possible companies. This guarantees the most accurate price comparison and a better comparison of the market.

Astonishing but true, 70% of consumers have remained with the same car insurance company for well over three years, and just short of a majority have never compared quotes from other companies. American insurance shoppers can save 47% each year just by comparing rates, but most undervalue how much they could save if they bought a different policy.

The purpose of this post is to teach you a little about the most effective ways to compare rates and some tips to save money. If you have car insurance now, you will be able to reduce the price you pay using the concepts you’re about to learn. Although Tennessee drivers do need to understand the way insurance companies charge you for coverage and use it to find better rates.

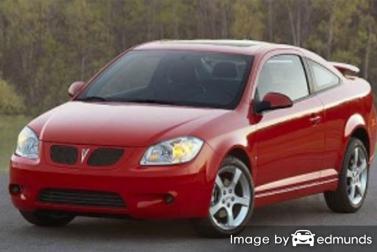

All major auto insurance companies allow consumers to get coverage price quotes from their websites. Doing online quotes for Pontiac G5 insurance in Nashville is quite easy as you just type in the amount of coverage you want as requested by the quote form. Upon sending the form, the quote system obtains reports for credit and driving violations and gives you a price quote. Getting online rates for Pontiac G5 insurance in Nashville makes it easy to compare insurance prices and it’s also necessary to have as many quotes as possible in order to get the cheapest price possible.

In order to find out if lower rates are available, compare quotes from the companies shown below. If you have your current policy handy, we recommend you copy the insurance coverages as shown on your current policy. This ensures you will have a price comparison using the same coverage and limits.

The following companies have been selected to offer quotes in Tennessee. If you want to find cheap car insurance in Nashville, we recommend you visit as many as you can in order to get a fair rate comparison.

Get discounts on Nashville insurance

Properly insuring your vehicles can get expensive, but discounts can save money and there are some available to help bring down the price. Some discounts apply automatically at the time of purchase, but once in a while a discount must be requested specifically prior to receiving the credit.

- First Accident Forgiveness – Not necessarily a discount, but a handful of insurance companies will forgive one accident without getting socked with a rate hike if you have no claims for a particular time prior to the accident.

- Pay Now and Pay Less – By paying your policy upfront instead of making monthly payments you can avoid monthly service charges.

- Buy New and Save – Buying a new car model is cheaper due to better safety requirements for new vehicles.

- Responsible Driver Discount – Drivers who avoid accidents can save as much as half off their rates than their less cautious counterparts.

- Discounts for Government Workers – Being employed by or retired from a federal job could qualify for a slight premium decrease depending on your insurance provider.

We need to note that many deductions do not apply to the whole policy. Most cut the cost of specific coverages such as physical damage coverage or medical payments. So when the math indicates all the discounts add up to a free policy, insurance companies wouldn’t stay in business.

The best insurance companies and a partial list of their discounts include:

- Progressive offers premium reductions for multi-policy, good student, online quote discount, continuous coverage, online signing, and homeowner.

- AAA may include discounts for good student, pay-in-full, multi-car, anti-theft, education and occupation, AAA membership discount, and good driver.

- Farmers Insurance offers discounts for business and professional, teen driver, pay in full, bundle discounts, good student, alternative fuel, and early shopping.

- GEICO policyholders can earn discounts including anti-lock brakes, membership and employees, five-year accident-free, good student, emergency military deployment, and federal employee.

- Esurance has discounts for online shopper, online quote, multi-car, DriveSense, and claim free.

- SAFECO discounts include homeowner, teen safe driver, anti-lock brakes, drive less, and bundle discounts.

- State Farm offers discounts including driver’s education, defensive driving training, passive restraint, good student, accident-free, and good driver.

Before purchasing a policy, check with every company to give you their best rates. Some discounts might not be offered in every state.

Decisions You Make Can Impact Your Insurance Premiums

Many different elements are used when premium rates are determined. Some of the criteria are obvious such as your driving history, but other criteria are not as apparent such as your marital status or your vehicle rating.

Shown below are a few of the things companies use to determine your premiums.

- Insurance lapses raise premiums – Going without insurance can be a sure-fire way to increase your insurance rates. Not only will rates go up, the inability to provide proof of insurance might get you fines and jail time. You may then be required to file a SR-22 with the Tennessee motor vehicle department to get your license reinstated.

- Your age impacts your premiums – Teen drivers in Tennessee tend to be more careless with other occupants in the car so they pay higher insurance rates. More mature drivers are viewed as being more responsible, file fewer claims, and are generally more financially stable.

- Amount of liability – Your insurance policy’s liability coverage will protect you when you are responsible for personal injury or accident damage. This coverage provides legal defense coverage to defend your case. It is affordable coverage compared to comp and collision, so drivers should carry high limits.

- Insurance rates for married couples – Your spouse may earn you lower rates on your policy. Having a significant other translates into being more financially stable and insurance companies reward insureds because married couples file fewer claims.

- Excellent credit equals lower prices – Having a good credit history will be a significant factor in determining what you pay for insurance. Insureds with high credit scores tend to be better risks to insure than drivers who have poor credit scores. If your credit rating is low, you could be paying less to insure your Pontiac G5 by improving your credit score.

- More policies can equal more savings – Lots of insurance companies allow a discount to insureds that have more than one policy, otherwise known as a multi-policy discount. The discount can add up to five, ten or even twenty percent. Even with this discount, you still need to compare other Nashville G5 insurance rates to verify if the discount is saving money. Consumers may save even more by insuring with multiple companies.

- Rate your vehicle for proper use – The more you drive annually the higher the price you pay to insure it. Most companies price each vehicle’s coverage based upon how you use the vehicle. Vehicles left parked in the garage qualify for better rates than those used for commuting. Incorrect rating for your G5 can cost quite a bit. It’s a smart idea to ensure your policy properly reflects the correct usage, because improper ratings can cost you money.