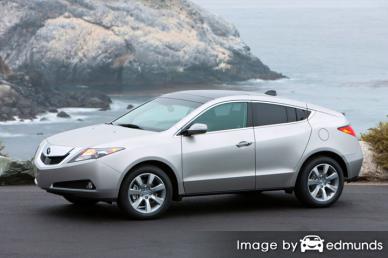

Want to learn how to find low-cost Acura ZDX insurance in Nashville? Did a good deal turn into high-priced Acura ZDX insurance in Nashville? Don’t feel bad because there are lots of people in the same boat.

Want to learn how to find low-cost Acura ZDX insurance in Nashville? Did a good deal turn into high-priced Acura ZDX insurance in Nashville? Don’t feel bad because there are lots of people in the same boat.

It’s shocking but most Tennessee car insurance customers have stayed with the same insurance company for well over three years, and nearly 40% of drivers have never compared rates from other carriers. Many drivers in the U.S. can save hundreds of dollars each year by just shopping around, but they don’t know the big savings they would realize if they bought a different policy.

Steps to buying lower priced Acura ZDX insurance in Nashville

If you want to save money, the best way to get budget car insurance rates in Nashville is to start comparing prices regularly from companies that insure vehicles in Tennessee.

First, read about policy coverages and the factors you can control to drop your rates. Many things that result in higher prices such as tickets, at-fault accidents, and an imperfect credit rating can be remedied by making small lifestyle or driving habit changes.

Second, compare price quotes from independent agents, exclusive agents, and direct companies. Exclusive agents and direct companies can only give rate quotes from a single company like GEICO and Allstate, while independent agents can quote prices from multiple insurance companies.

Third, compare the quotes to your current policy premium to determine if switching companies saves money. If you find a better price and change companies, make sure the effective date of the new policy is the same as the expiration date of the old one.

One bit of advice is to try to compare the same deductibles and limits on every quote and and to get rates from as many car insurance companies as possible. This guarantees an accurate price comparison and the best price selection.

There is such a variety of car insurance companies to buy insurance from, and although it’s a good thing to have multiple companies, more options can take longer to adequately compare rates for Acura ZDX insurance in Nashville.

Finding affordable car insurance coverage in Nashville is quite easy if you know the best way to do it. If you have a policy now, you will definitely be able to find the best rates using the techniques covered below. You just need to know the fastest way to shop their coverage around from multiple carriers.

How to find affordable Acura ZDX insurance in Nashville

Most major insurance companies such as State Farm, Allstate and GEICO allow you to get coverage price quotes direct online. Getting Acura ZDX insurance prices online doesn’t take much effort because it’s just a matter of typing in your coverage information into the form. Upon sending the form, their quoting system obtains your driving record and credit report and generates pricing information based on these and other factors. This makes it easy to compare insurance prices and it is important to compare as many rates as possible if you want to find a better rate.

To find out what other companies charge, compare rates from the companies below. If you have a policy now, it’s recommended that you enter the insurance coverages exactly as shown on your declarations page. This way, you will have a rate comparison using the exact same coverages.

The companies shown below provide quotes in Tennessee. To buy cheap auto insurance in Tennessee, it’s highly recommended you get price quotes from several of them in order to find the lowest rates.

Car insurance statistics and figures

The table shown below outlines a range of insurance premium costs for Acura ZDX models. Having a good grasp of how rate quotes are determined is important for drivers to make decisions when shopping around.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| ZDX Technology Package AWD | $148 | $266 | $272 | $16 | $82 | $784 | $65 |

| ZDX AWD | $148 | $266 | $272 | $16 | $82 | $784 | $65 |

| ZDX Advance Package AWD | $148 | $302 | $272 | $16 | $82 | $820 | $68 |

| Get Your Own Custom Quote Go | |||||||

Data assumes married female driver age 50, no speeding tickets, no at-fault accidents, $1000 deductibles, and Tennessee minimum liability limits. Discounts applied include safe-driver, multi-vehicle, homeowner, claim-free, and multi-policy. Rate quotes do not factor in specific zip code location which can increase or decrease coverage rates substantially.

Car insurance prices based on gender

The example below illustrates the comparison of Acura ZDX insurance rates for male and female drivers. The costs are based on no claims or violations, comprehensive and collision coverage, $250 deductibles, drivers are not married, and no discounts are applied.

Does full coverage make sense?

The illustration below shows the difference between Acura ZDX insurance premiums with and without physical damage coverage, medical payments, and uninsured/under-insured motorist coverage. Data assumes no claims, a clean driving record, $1,000 deductibles, drivers are not married, and no policy discounts are applied.

When to stop buying comprehensive and collision coverage

There isn’t a written rule of when to drop physical damage insurance, but there is a broad guideline. If the annual cost of comprehensive and collision coverage is about 10% or more of any settlement you would receive from your insurance company, the it may be a good time to stop paying for full coverage.

For example, let’s say your Acura ZDX claim settlement value is $8,000 and you have $1,000 policy deductibles. If your vehicle is damaged in an accident, the most your company would pay you is $7,000 after paying the physical damage deductible. If you are paying in excess of $700 annually for your policy with full coverage, then you might want to consider buying only liability coverage.

There are some circumstances where dropping physical damage coverage is not a good plan. If you still have a lienholder on your title, you have to keep full coverage as part of the loan requirements. Also, if your finances do not allow you to purchase a different vehicle in the even your car is totaled, you should not eliminate full coverage.

Insurance Rate Influencing Factors

Lots of things are taken into consideration when you get your auto insurance bill. Some of the criteria are obvious like a motor vehicle report, although others are less apparent such as your marital status or your financial responsibility. Consumers need to have an understanding of the rating factors that come into play when calculating your policy premiums. If you have some idea of what impacts premium levels, this helps enable you to make changes that could result in lower car insurance prices.

- Do you really need to file those policy claims? – Auto insurance companies in Tennessee generally give most affordable rates to drivers who do not rely on their insurance for small claims. If you tend to file frequent claims, you can expect higher rates. Your car insurance is intended to be relied upon for larger claims.

- Credit score impact car insurance premiums – Credit history factor in your rate calculation. If your credit history can use some improvement, you could be paying less to insure your Acura ZDX by improving your credit score. People that have high credit scores tend to be better drivers and file fewer claims as compared to drivers with poor credit scores.

-

How old are your drivers? – Teenage drivers in Tennessee are proven to be inattentive and easily distracted with other occupants in the car so car insurance rates are higher. Having to add a teen driver to your car insurance policy can cause a big jump in price. Older insureds are more responsible, cause fewer claims and accidents, and usually have better credit.

The data below assumes a single driver, full coverage with $100 deductibles, and no discounts or violations.

- A policy lapse is a bad thing – Driving with no insurance is not a good idea and companies may charge more for letting your coverage lapse. Not only will you pay higher rates, getting caught without coverage can result in a license revocation or jail time. You may have to submit proof of financial responsibility or a SR-22 with the Tennessee motor vehicle department.

- Alarms and GPS tracking lower prices – Choosing to buy a car that has an advanced theft prevention system can save you a little every year. Theft prevention features like tamper alarm systems, vehicle immobilizer technology and General Motors OnStar all help prevent car theft and help bring rates down.

- Occupation stress can make you pay more – Occupations such as lawyers, business owners, and dentists usually pay higher average rates due to job stress and lengthy work days. Conversely, jobs like farmers, historians and retirees have lower than average premiums.

Insurance is not optional but you don’t have to overpay

Despite the fact that insurance is not cheap in Nashville, maintaining insurance serves several important purposes.

- Just about all states have minimum mandated liability insurance limits which means the state requires specific minimum amounts of liability protection if you drive a vehicle. In Tennessee these limits are 25/50/15 which means you must have $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $15,000 of property damage coverage.

- If you have a loan on your ZDX, almost every bank will require that you have comprehensive coverage to protect their interest in the vehicle. If coverage lapses or is canceled, the bank or lender will purchase a policy for your Acura at a more expensive rate and force you to pay much more than you were paying before.

- Insurance safeguards your vehicle and your assets. It will also pay for all forms of medical expenses for you, your passengers, and anyone else injured in an accident. Liability coverage also pays expenses related to your legal defense if someone files suit against you as the result of an accident. If mother nature or an accident damages your car, your policy will pay to restore your vehicle to like-new condition.

The benefits of insuring your car more than offset the price you pay, specifically if you ever have a liability claim. On average, a vehicle owner in Nashville is currently overpaying as much as $700 annually so you should quote rates at every renewal to ensure rates are inline.

Tennessee auto insurance company ratings

Ending up with the top auto insurance company is hard considering how many companies are available to choose from in Nashville. The ranking information displayed below could help you choose which car insurance companies you want to consider purchasing a policy from.

Top 10 Nashville Car Insurance Companies Ranked by Customer Service

- USAA

- Travelers

- Mercury Insurance

- AAA Insurance

- Nationwide

- Safeco Insurance

- Progressive

- State Farm

- The Hartford

- The General